Welcome to Capital Fluency

Accomplish More

Risk Less

Capital Fluency’s investing experts achieve your financial objectives and grow your net worth

OUR APPROACH

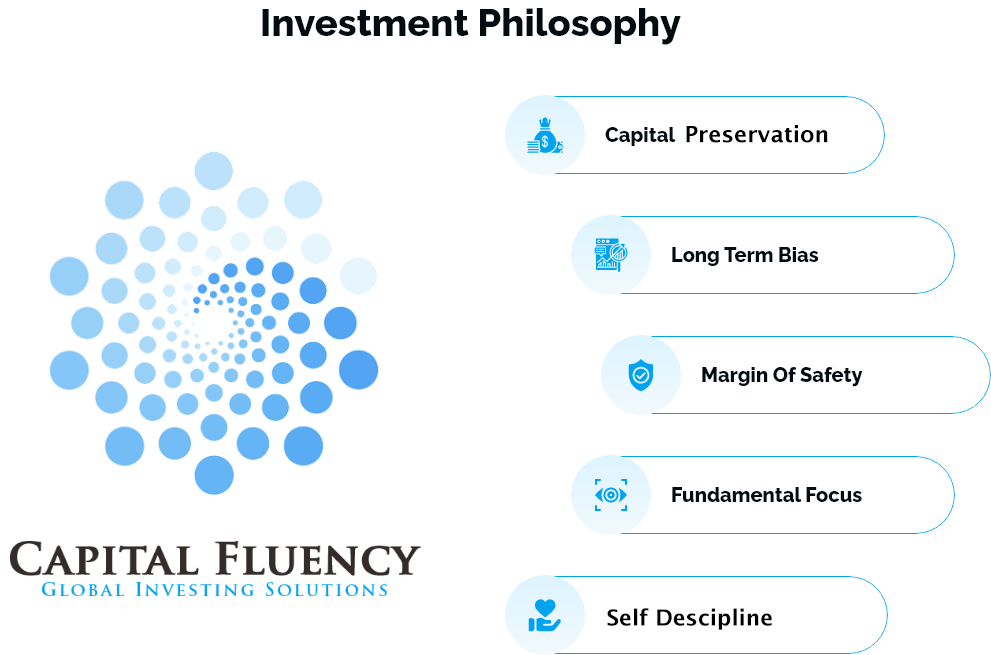

We aim to reduce the negative moves of the market by actively managing your portfolio. We are disciplined investors with a razor focus on capital preservation. We are prudent and don’t speculate.

OUR EXPERIENCE

We have two decades of global investing expertise, honed at top institutions like Goldman Sachs and PIMCO. We strive to deliver superior investment results within a risk-managed framework.

OUR SERVICES

We do extensive research to identity the investments suited for your needs and help deliver strong investment results. We guide you on tax and wealth planning.

Investment Solutions

Hi I'm Danny

Chief Investment Officer, Portfolio Manager

PIMCO, Harvard Business School

I have been very fortunate to have amassed a wealth of investing experience. For the past twenty years, my career has been on an accelerated pace working for some of the best and most reputed money managers in the world. I have invested billions not just in the US but also across Europe, Japan, and Emerging markets. As a fundamental investor, my focus has been on evaluating the strengths of each company’s business model, the quality of its management teams, and the prevailing macro and competitive backdrop.

Through Capital Fluency, our goal is to broadly share the analytical framework used by institutional investors to construct investment portfolios. I believe this rigor is currently lacking in the wealth management industry with many financial advisors often taking a cowboy approach, resulting in either subpar returns or excessive risk.

Prior to starting Capital Fluency, I was a Portfolio Manager at PIMCO in Newport Beach where I combined my fundamental investing skills with tactical asset allocation strategies to find superior investment opportunities. I started my career at Goldman Sachs in New York and was part of the core team overseeing investment activities for billionaire Paul Allen in Seattle.